By William Berkson:

Tax reform is not a zero-sum game. Since Ronald Reagan lowered taxes in the 1980s, followed by George W. Bush in the early 2000s and Donald Trump last year, middle class income has stagnated despite productivity increases, and overall economic growth has been mediocre. Instead of lose-lose, we can have win-win, bolstering both fairness and economic growth through sensible tax reform and wise investment of added revenues.

Fairness in taxation means finding the right balance between the taxpayer’s ability to pay and the benefits from government use of tax dollars. As I showed in a previous article government investment in education, research, and infrastructure could hugely benefit economic growth and good jobs.

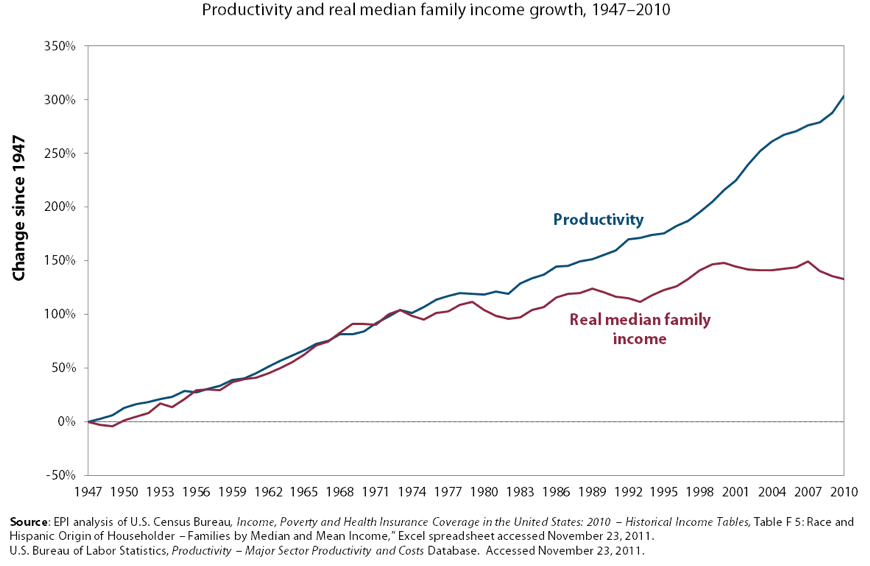

The rich are not paying their fair share today. The chart accompanying this article the Economic Policy Institute shows the growing gap between median family incomes and the value of goods and services that a worker creates. Since 1980, the additional value added by each worker has gone more and more to bosses, not employees

Eliminating the Republican-passed tax breaks for the wealthy, and publicly investing the revenues would create better paying jobs, and help close this gap.

Looking only at unnecessary and unfair tax favors to wealthy individuals and families, three tax breaks stand out for targets for reform. Cutting these would raise an estimated $4 trillion over 10 years without material harm to the rich.

- Raise capital gains tax

The argument for taxing capital gains at half earned income is that it spurs investment and growth. But the non-partisan Congressional Research Service has been unable to find any such effect. Moreover, most of the benefit flows to the wealthiest, who are predominantly the owners of capital. Nearly three quarters of the additional revenue coming from eliminating the capital gains tax break would come from those earning over $1,000,000 annually.

Additional estimated revenue over 10 years: $500 billion

- Broaden the estate tax

Fair taxes is partly a matter of ability to pay, and the dead don’t suffer when they pay taxes. It is also inherently unfair to give heirs 100% of what they didn’t work to earn. We are, as famed economist Thomas Piketty has pointed out, rapidly moving toward those with inherited wealth being the majority of the wealthy—and the danger of being ruled by them, such as Donald Trump. The base exemption should be restored to the level under Clinton, and loopholes closed.

Additional estimated revenue over 10 years: $1 trillion

- Restore top income tax rates from pre-Reagan era

Before Reagan, in the post-war period the top tax bracket was taxes at never less than 70%—and the economy grew more, and much more equally. After Reagan, with the top rate remaining below 40%, the taxation table was so tilted that all the money from increased productivity of workers slid over to bosses’ side. Each 1% you raise the taxes on the top bracket of those in the top 4% of income—dollars over $233,000 per year for a household—would raise about $120 billion over ten years. The study of rich (OECD) countries since 1960 found the top rate associated with the most economic growth was 60% — we should restore it to this level.

Additional estimated revenue over 10 years: $2.5 trillion

How can Democrats convince voters that increased taxation is needed to fully support needed public investment, as well as economic security programs such as health care and social security?

We need look no farther than Bill Clinton, who got it right in 1992 when he ran and won on the promise to “make the rich pay their fair share”. Clinton was blocked from further tax increases after 1994, so rich still gained disproportionately. But still, under Clinton we had the best economic growth in recent times, and median incomes actually grew.

The facts are on the side of fairer taxation and more public investment—we just need to deliver the message.

William Berkson is a member of Hunter Mill District Democratic Committee and chair of Herndon Reston Indivisible’s Economics Committee. A PhD in Philosophy, he is author of four recent articles on political economy in Washington Monthly

These are sensible proposals. Come join us to discuss a wealth tax at the Vienna Community Center, 120 Cherry St. SE, Vienna, VA on Saturday, May 19, 2018, from 10:00 AM to Noon. The event is called “Neighbors for a Universal Income.

The Republican tax cut of December 2017 was an atrocious gift to the 1%. We should hear more about that from Democrats. The CBO published the distributional effects of that tax cut but they put the tax benefit and the number of tax units in two separate tables. Click here to see them.

Thanks! And thanks for the tables and calculations. I didn’t go into either corporate taxes, which are very complex. One of the best other proposals I think is for a financial transactions tax. Here Economist Dean Baker says that a .2% tax on trading equities and a .01% on derivatives would also raise 1 to 1 1/2 trillion over ten years. That’s a kind of wealth tax, but specifically targeted toward unproductive “rent” income, which makes it particularly attractive. (This is now a chapter in a book): https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=0ahUKEwiittmg8orbAhVCwVkKHYGPDJ8QFggnMAA&url=https%3A%2F%2Fwww.aeaweb.org%2Fconference%2F2017%2Fpreliminary%2Fpaper%2F4NHSb4ET&usg=AOvVaw2Mhz3AQYybKxuQOGjIEFzf